s corp tax calculator nyc

All shareholders who earn wages or a salary from a C Corporation must pay self-employment tax. Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps.

Ny State And City Payment Frequently Asked Questions

An S-corps income is taxable for the shareholders when it is earnedwhether or not the corporation distributes the income.

. Federal Taxes for C Corps. Trumps family business is scheduled to resume in State Supreme Court in Manhattan on Thursday after not having met. Estimated Local Business tax.

For example if you. S corp tax calculator nyc Thursday September 8 2022 Edit. Total first year cost of S-Corp.

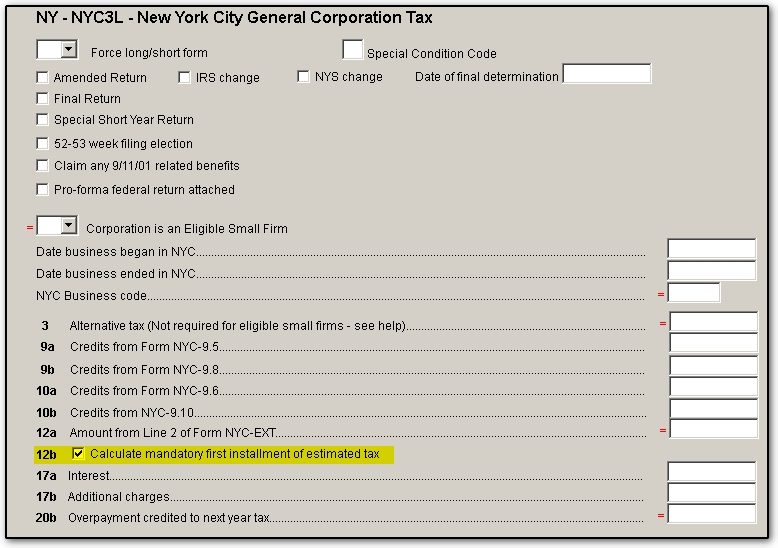

This amount may not exceed the value on line 9. Years that may be used in the current tax year for City purposes. General Corporation Tax GCT Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. See more information on filing and paying corporation tax for. The way you compute the tax and the type of return you file will depend on the type of business your corporation conducts.

This application calculates the. Photo by Dimitry Anikin. Annual cost of administering a payroll.

Annual state LLC S-Corp registration fees. The tax-fraud trial of Donald J. This tax is administered by the Federal Insurance Contributions.

In NYC the GCT is imposed on S corporations at a rate of 885. Interest Rates for NYC Income Excise Taxes. For example in New York.

S-corp income and expenses are subject to special rules. Line 11 - Subtract Line 10 from Line. Enter carryover loss as a positive number.

Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted. For example if you have a. However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885.

10 2022 500 am.

Download Pdf Exploring A Land Tax Approach With An Online Calculator

What Double Taxation Is And How To Avoid It Smartasset

S Corp Taxes S Corp Tax Benefits Truic

Sales Taxes In The United States Wikipedia

Becoming Less Valuable S Corporation Reasonable Compensation In Light Of Irc 199a Berdon Llp

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

S Corporation How To Start An S Corp As A Security Guard

Should You Choose S Corp Tax Status For Your Llc Smartasset

How To Convert To An S Corp 4 Easy Steps Taxhub

Use This S Corporation Tax Calculator To Estimate Taxes

S Corp Tax Secrets Tax Savings Strategies 2023 White Coat Investor

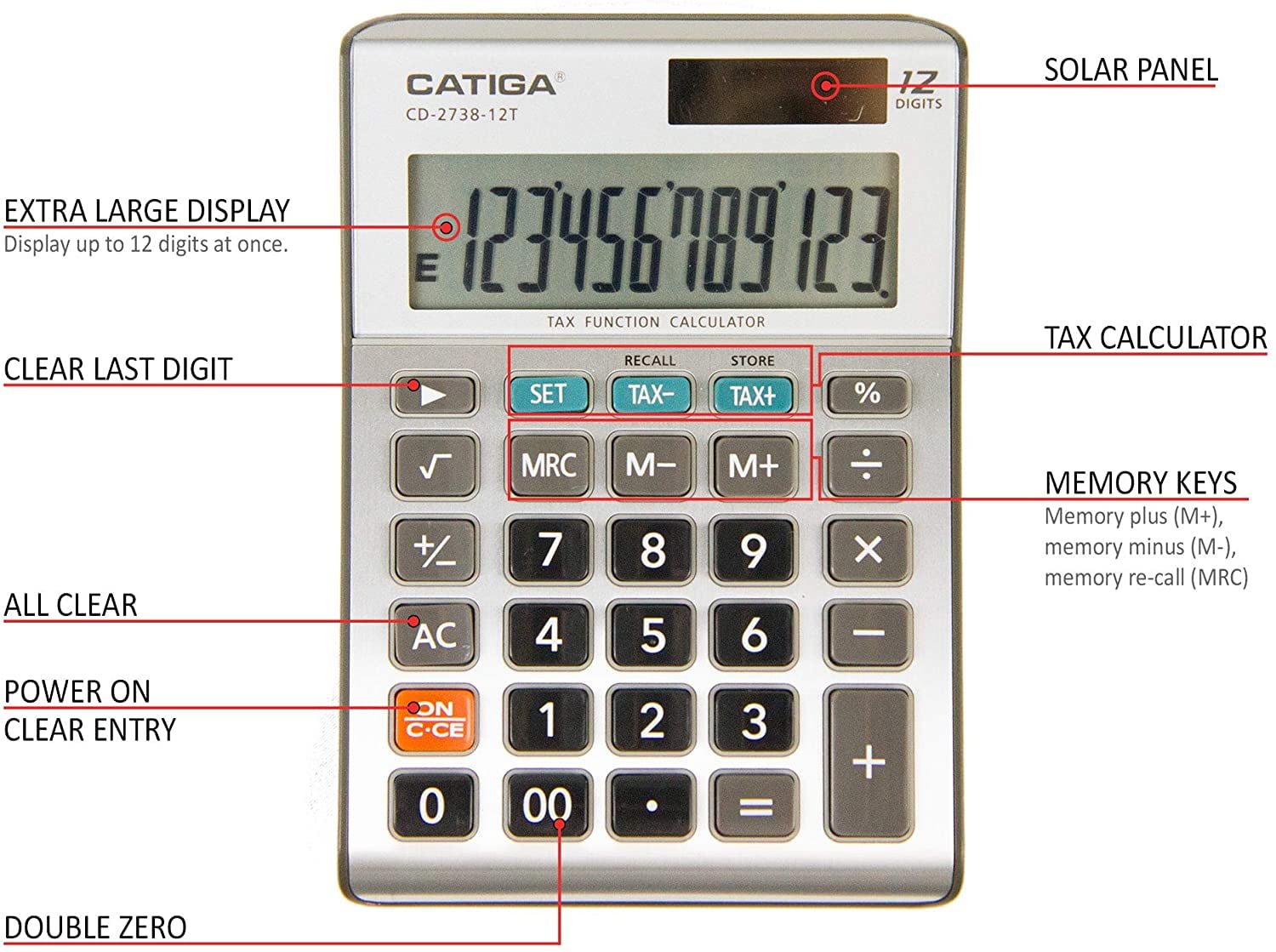

12 Digit Business Calculator Catiga Cd 2738 12t Dual Power Tax Calculator Silver Walmart Com

Sales Taxes In The United States Wikipedia

Los Angeles Sales Tax Rate And Calculator 2021 Wise

2017 Online 1040 Income Tax Calculator

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

New York State Taxes For Small Businesses An Overview Bench Accounting